A growing number of millionaires, super-rich, and ultra-wealthy investors are moving to Italy, driven by its attractive flat tax regime and lifestyle appeal. This global phenomenon, known as wealth migration, is reshaping global investment trends and turning the country into a new tax haven for high-net-worth individuals (HNWIs). According to the latest data, over 142,000 millionaires are expected to move worldwide in 2025, with Italy ranking as a top destination and a projected growth to 165,000 in 2026.

Italy: A Leading Destination in the Global Wealth Exodus

Italy is now the third most attractive destination globally for millionaires in 2025, trailing only the United Arab Emirates (9,800 incoming millionaires) and the United States (7,500 incoming millionaires). The nation ranks ahead of Switzerland, Saudi Arabia, and Singapore and is set to welcome approximately 3,600 millionaires, who are bringing an estimated $21 billion in private capital.

The wealth exodus is accelerating worldwide, driven by geopolitical instability and shifting tax regimes. With countries like the UK losing their appeal due to the abolition of the non-dom tax status, Italy has positioned itself as a competitive and welcoming alternative.

With Spain saying goodbye to the Golden Visa and the abolition of the Res Non Dom regime in the UK, Italy is the new luxury real estate tax paradise – read the article in Dreamer Magazine.

The Flat Tax Advantage Behind the Wealth Exodus

The key to Italy’s success lies in its favorable flat tax system for new residents. Under the flat tax regime, foreign residents can opt to pay a fixed annual tax of €200,000 on their worldwide income, regardless of its actual amount. Family members can be added for an additional €25,000 per year each. This competitive fiscal framework, valid for up to 15 years, is highly attractive to international investors seeking long-term stability and financial efficiency.

Learn more about Luxury Real Estate in Italy and Flat Tax Benefits.

High-Profile Millionaires and Super-Rich Moving to Italy

The millionaire exodus to Italy is not just about numbers. Several prominent figures have already relocated, including:

- Elio Leoni-Sceti, former CEO of EMI Music.

- Bart Becht, former CEO of Reckitt Benckiser.

- Fersen Lambranho, Brazilian billionaire investor.

- Richard Gnodde, Goldman Sachs veteran.

- Nassef Sawiris, one of the wealthiest men in Egypt and co-owner of Aston Villa.

According to the Henley Private Wealth Migration Report 2025, Italy will welcome about 3,600 new millionaires over the year, surpassing historic destinations such as Switzerland. This growing trend confirms why so many wealthy people are moving to Italy: tax efficiency, security, and the unmatched Italian lifestyle.

Read the article: Italy Tops the Charts for High-End Property Investments.

In the European scenario, while countries such as the United Kingdom, France, and Germany are experiencing a decline in wealthy residents due to less favorable tax regimes, or the cancellation of programs such as the British non-dom, Italy is emerging as a new hotspot. The United Kingdom, for example, is set to lose some 16,500 millionaires in 2025 alone, the largest capital flight ever recorded in a single year.

The Impact on Italy’s Luxury Real Estate Market

This influx of HNWIs is significantly boosting Italy’s luxury real estate market. Exclusive properties such as historical villas, prestigious countryside estates, and penthouses with unique views are now trading between €7 to €15 million. Luxury rentals are also booming, with annual prices reaching up to €140,000 for the most exclusive properties.

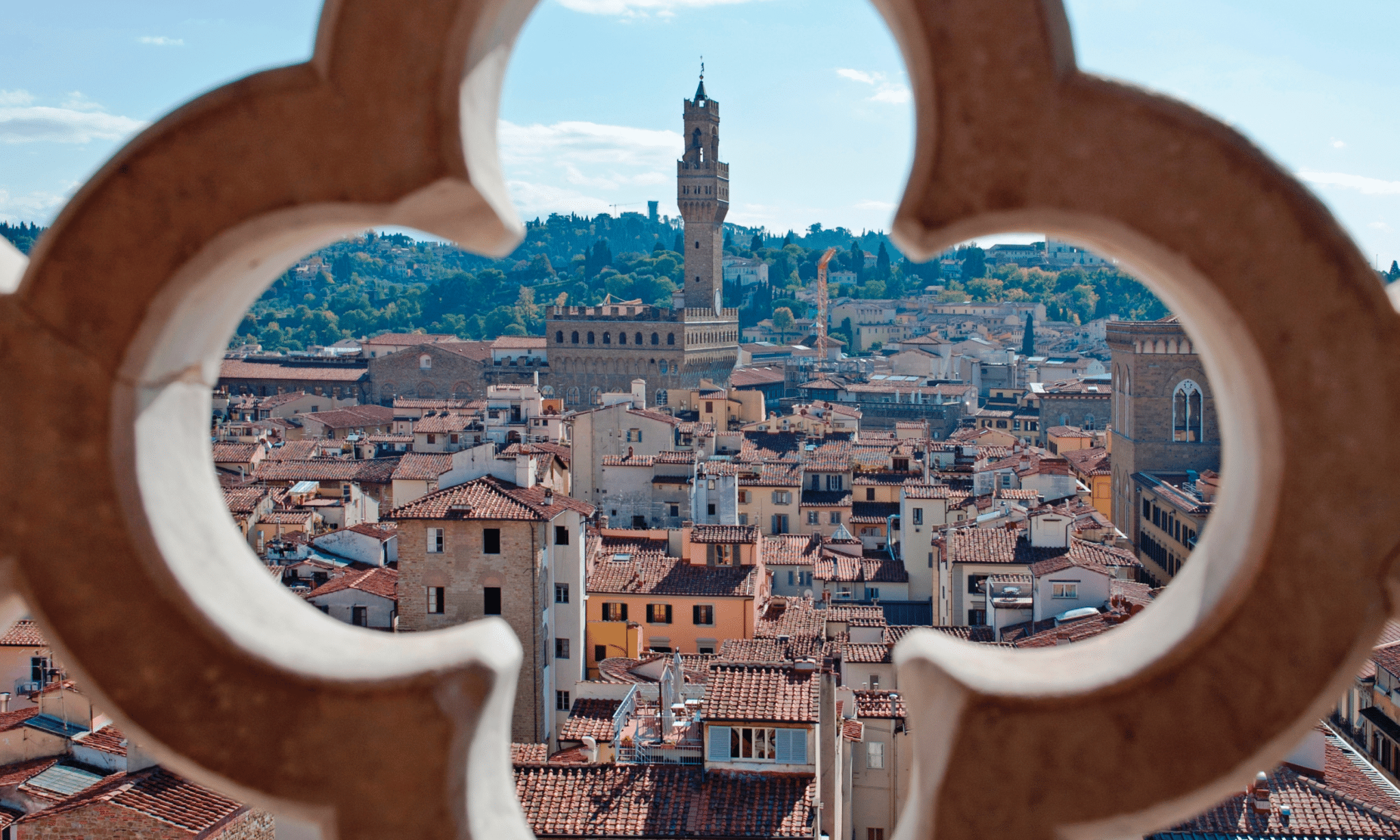

Regions like Tuscany are among the most sought-after destinations for wealthy buyers, thanks to their heritage, lifestyle, and privacy. This confirms Italy’s growing role as a top global hub for global wealth and luxury real estate investment. In 2023, 1,495 millionaires joined the Flat Tax regime in Italy.

Italy is The New Global Hub for Wealth

While London loses fiscal attractiveness, Italy collects benefits from forward-looking policies. This scenario, combined with international uncertainty, such as the U.S. tariffs announced by Trump, is redefining global investment strategies.

Between competitive tax advantages and an unparalleled quality of life, the Bel Paese is emerging as one of the most prestigious destinations for those seeking to invest in luxury real estate and establish a new elite residence.

Looking to invest in Italy’s booming luxury real estate market or relocate under the flat tax regime? Dreamer Real Estate is your trusted partner for discovering the most exclusive properties and navigating the investment process with bespoke expertise.

How will the market continue to evolve? Find out by following Dreamer Magazine!