In the global financial landscape, the Res Non-Dom tax status has long made the United Kingdom a prime destination for entrepreneurs, investors, and high-net-worth individuals (HNWI). However, the recent decision by the UK government to abolish this regime has unsettled the international financial elite, prompting many millionaires to explore new tax-efficient opportunities.

Res Non-Dom Tax Status Abolished in the UK

The UK’s Res Non-Dom tax regime allowed foreign nationals residing in the UK to pay taxes only on their remitted income, making the country highly attractive to wealthy individuals. Its abolition marks a significant shift, reshaping international tax planning strategies for affluent investors.

In an effort to increase tax revenues and reduce social inequality, the UK government has closed a historic chapter that had drawn some of the world’s most influential tycoons. However, this decision may backfire economically, accelerating the exodus of capital toward more favorable jurisdictions. According to the Adam Smith Institute, the percentage of millionaires in the UK is projected to decline from 4.55% to 3.62% by 2028 (-20%).

New Tax Rules: What Changes in the UK from 2025?

Starting April 6, 2025, the concept of “domicile” will be replaced by a residency-based tax system. For individuals who have not been UK residents in the previous ten years, a four-year transitional regime (FIG) will be introduced, allowing tax exemptions on foreign income and gains for a limited period. However, after this period, taxation on foreign trusts and global assets will increase significantly, making long-term residence in the UK less attractive.

The Millionaire Exodus: Italy Attracts Former Non-Doms with Tax Benefits and a Luxury Lifestyle

According to the London School of Economics, in 2022, 1 in 5 bankers in the UK was a Non-Dom, and 40% of those earning over £5 million in 2018 had benefited from this status. Now, many are considering relocating to tax-friendly jurisdictions.

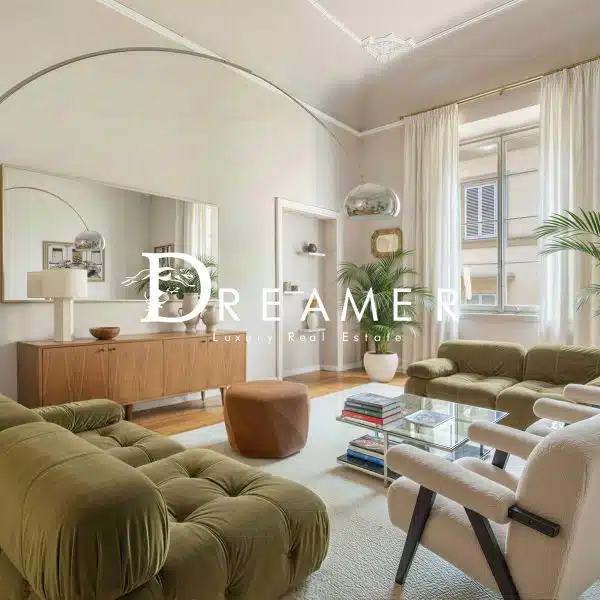

Discover Luxury Real Estate in Italy: High-End Homes, Low Taxes.

With the end of the Res Non-Dom regime, Italy is emerging as one of the most attractive destinations for HNWIs and Ultra HNWIs seeking tax stability and an exclusive lifestyle. In addition to the Flat Tax advantages, the country offers an irresistible mix of beauty, culture, and quality of life.

Italy embodies La Dolce Vita, a perfect blend of elegance, art, and gastronomy that appeals to those seeking a sophisticated living experience. Tuscany and Umbria have become prime destinations for those seeking an authentic lifestyle, away from the urban hustle and bustle, without compromising on luxury.

Discover more:

- Italy: The Ultimate Destination for American Expats

- Living in Italy: Tuscany and Umbria

- Slow Living is the New Luxury

Italy not only offers tax advantages but also exclusive relocation services, including legal and tax assistance and support for purchasing luxury properties.

Read on Dreamer Magazine our guide to the Digital Nomad Visa and relocation to Italy.

Luxury real estate in Italy is booming, with heritage villas, wine estates, and luxury mansions attracting investors from around the world. The city center remains one of the most sought-after destinations, while restored hamlets and rustic farmhouses are gaining popularity among millionaires looking for an exclusive retreat in the heart of the Italian countryside. It is a back-to-country life trend.

Impact on Luxury Real Estate

The abolition of the Res Non-Dom status is already impacting luxury real estate. London, long one of the most desirable property markets, may experience a slowdown in high-profile transactions. According to some sources, prominent figures such as David Sullivan (West Ham United) and Charlie Mullins (Pimlico Plumbers) are already selling their luxury properties in London, concerned about rising taxation.

Meanwhile, Italian cities like Florence are preparing to welcome this wealthy clientele, offering attractive real estate opportunities. Timing is crucial for investors: the capital reallocation to more competitive destinations could generate new luxury real estate possibilities, influencing pricing dynamics and exclusive property availability.

Expat Life with Dreamer

The abolition of the Res Non-Dom regime in the UK marks a turning point for global wealth management. In this changing landscape, countries with favorable tax regimes are emerging as new hubs for high-net-worth individuals.

Now more than ever, Italy presents itself as an attractive and stable destination for those seeking to invest in luxury real estate. With its rich cultural history, unique landscapes, and resilient real estate market, Italy offers a safe haven. And also an opportunity to live in some of the world’s most beautiful locations.

High-net-worth individuals seeking new opportunities in Italy’s luxury real estate market need strategic partners for their transactions. Dreamer Real Estate, with deep knowledge of the local market and the ability to provide personalized service, guides investors through every step of the process, ensuring each purchase is a thoughtful and advantageous decision.

Don’t let regulatory changes limit your aspirations. Invest in luxury real estate in Italy with Dreamer.