Important news in the luxury real estate market: Spain has officially discontinued the Golden Visa program. For years, this program has attracted international investors who seek to purchase luxury real estate on Iberian land with significant tax breaks.

Pedro Sánchez government’s decision marks a turning point in Spain’s luxury real estate market, with deep implications for foreign buyers who have invested in second homes in the country’s most exclusive locations.

As of April 3, 2025, non-EU investors seeking to purchase property in Spain will lose their right to a privileged residency permit, and will also have their homes fully taxed. This decision follows growing political and social pressures due to soaring property prices attributed to the foreign capital inflow. In particular, the Spanish government believes that many investors have been buying properties “not to live in but to speculate,” fueling the housing crisis in major cities and tourist areas.

Implications for Luxury Real Estate

The effect of these changes is presumed to be immediate and significant. Foreign buyers who have made Spain one of their favorite destinations for second homes will now pay 100% tax without any tax benefit. With more than 200,000 UK residents already owning property in Spain, the new tax regime could drastically reduce the Iberian market’s attractiveness to foreign investors. They are now oriented toward more favorable destinations for buying and selling prestige properties.

Italy: a Tax Haven for Foreign Investors

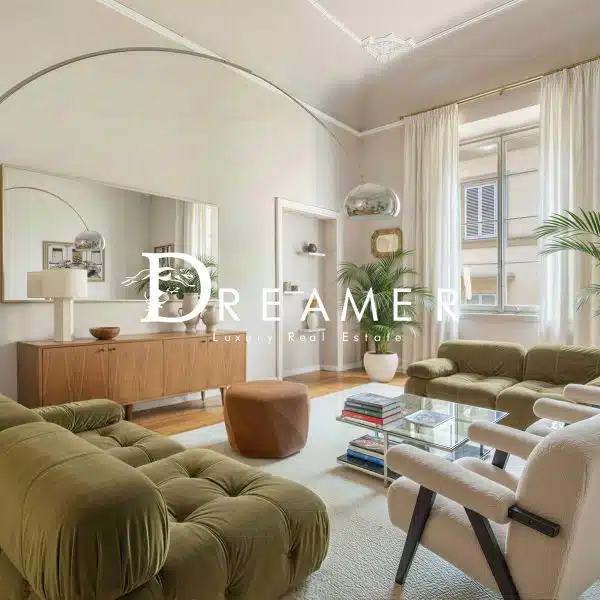

While Spain closes its doors to foreign real estate investors, Italy remains an increasingly attractive destination for those seeking residency and tax advantages. Unlike the Spanish government, the Italian one adopted a targeted incentive policy to attract international capital, making it one of the most sought-after destinations in luxury real estate.

Learn more about 2025 trends in luxury real estate in Italy and discover in our Dreamer Talks how to buy a home in Italy.

Tax Breaks for New Residents in Italy

Italy offers a highly tax-friendly regime for new foreign residents. International investors appreciate the Digital Nomad Visa and the €200,000 annual Flat Tax on foreign income. An incentive that has already attracted many wealthy entrepreneurs and high-net-worth individuals (HNWIs) desiring to settle in the Bel Paese and enjoy the Italian lifestyle.

Exclusive Locations and Growing Real Estate Market

From panoramic villas in the Tuscan and Umbrian hills to historical palaces in Florence and exclusive residences in Chianti, Italy perfectly blends history, luxury, and strategic real estate investment.

The combination of luxury homes, a high quality of life, and tax breaks makes Italy the ideal destination for those seeking a safe and prestigious haven for their capital.

Recent trends indicate a growing demand for historic villas, heritage palaces, and residences with panoramic views, especially from U.S., British, and Middle Eastern buyers. With Spain closing its doors to investors, Italy has an opportunity to strengthen its position as Europe’s elite real estate hub.

Read our article,Italy: The Ultimate Destination for American Expats.

Spain vs. Italy: Where to Buy a Home?

With the Spanish Golden Visa’s abolition, the European luxury real estate landscape is experiencing a major transformation. While Spain has opted to restrict foreign investment in real estate, Italy is emerging as the ideal destination for those seeking a prestigious residence with favorable tax conditions.

For investors and high-end buyers, the Italian Peninsula is a place of timeless beauty and a real opportunity to maximize the value of their real estate assets.

Italy is the new frontier of luxury real estate for those seeking a safe and profitable property investment. An opportunity not to be missed for those who want to combine luxury, tax breaks, and timeless beauty.